Tags

China, Deficit, foreign debt, gross national debt, missouri, public debt, trade deficits, Vicky Hartzler

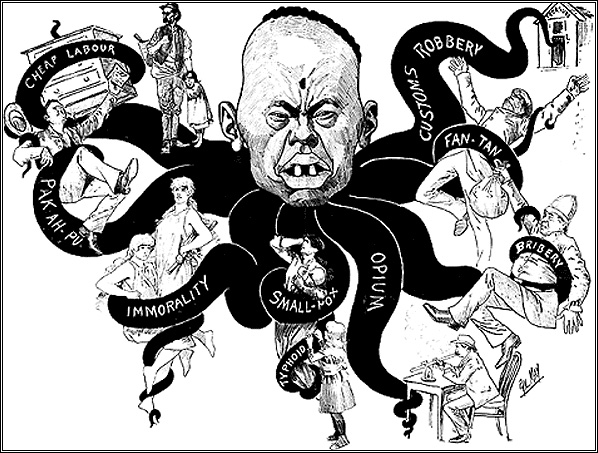

When I read Michael Bersin’s transcript of Rep. Vicky Hartzler’s (R-4) recent town hall meeting in Warrensburg, I was struck by a specific aspect of her effort to gin up hysteria about the national debt. If all else fails, trot out a scary picture of the foreign bête noire of the day, currently China, and you’ll fire up the xenophobes every time:

When I read Michael Bersin’s transcript of Rep. Vicky Hartzler’s (R-4) recent town hall meeting in Warrensburg, I was struck by a specific aspect of her effort to gin up hysteria about the national debt. If all else fails, trot out a scary picture of the foreign bête noire of the day, currently China, and you’ll fire up the xenophobes every time:

China owns twenty-nine percent of our foreign debt. That is a real concern to me. I said I’m on the Armed Services Committee and I’ve got to sit in a lot of hearings and I can tell you, I don’t know what China’s doing, but it’s concerning. They are building fourteen nuclear submarines right now. We’re building one. They have been devoting over twelve percent of their budget to national defense. Uh, they just introduced their version of a stealth aircraft fighter plane recently. And they just unveiled a twelve hundred mile aircraft carrier busting bomb. So, it’s a little concerning that they hold this much of our debt. In fact, with the interest that we pay China we would be able to buy three, or they could buy, three joint strike fighters and still have fifty million dollars left over. So, um, there’s a lot of reasons I think that we need to get out of debt. But certainly this obligation, um, to China is a concerning one.

First of all, if you’ll forgive me for a little nitpicking, Rep. Hartzler may be technically correct that China owns somewhere in the neighborhood of 29% of our foreign public debt – but she conveniently leaves out the fact that all foreign investors together, including China, own only 31% of our gross national debt*. China is no longer even the largest investor in that group. China currently owns only 8% of our gross national debt. See how it works – and how Hartzler is conflating different categories of debt to create a misleading impresion?

Further, as economist Dean Baker notes, “foreign borrowing is determined by the trade deficit, end of story,” and the value of the debt held by foreign entities is tied to the value of the dollar in relation to foreign currencies. This means that it is in China’s interest to prop up the dollar, which it does by buying U.S. Treasury bills, bonds, and notes. Their willingness to hold our marker, so to speak, is not directly affected by our deficit, nor is it likely to be affected by the domestic spending cuts Hartzler and her GOP cohorts advocate.

Further, as economist Dean Baker notes, “foreign borrowing is determined by the trade deficit, end of story,” and the value of the debt held by foreign entities is tied to the value of the dollar in relation to foreign currencies. This means that it is in China’s interest to prop up the dollar, which it does by buying U.S. Treasury bills, bonds, and notes. Their willingness to hold our marker, so to speak, is not directly affected by our deficit, nor is it likely to be affected by the domestic spending cuts Hartzler and her GOP cohorts advocate.

To be fair, some economists are concerned that if the U.S. is unable to get its debt under control long-term – and the idea of long-term vs. short term is key here – it will affect the confidence of investors like China. Most concede, however that in the case of China, our interests are so conjoined that there is little likelihood that they will do anything to endanger our prosperity. China depends on the U.S. to buy Chinese goods. Without a prosperous, ever-consuming U.S., Chinese growth stalls. As Adam Davidson of NPR’s Planet Money put it in an interview earlier this year:

… the only way China can hurt us is to completely destroy their own economy. China needs the U.S. and the U.S. dollar to stay healthy, to keep growing. What we have is mutually assured economic destruction.

Michael Bersin, quotes former Secretary of State Richard Armitage who was interviewed during a visit to Warrensburg a couple of years ago, and went so far as to assert that China’s internal stability depends on the United States economic viability.

… If the t-bills, if China withdrew, [i.e. sold off their U.S. debt] they would not be able to keep that economy humming along. They would have instant social upheaval in the countryside and probably in the cities.

So why is Hartzler trying to stoke fears about China, directly implying that China is somehow leveraging American debt to build up its military at the expense of U.S. defenses? As Personman, who was also present at the Warrensburg town hall, observed in the comments to Bersin’s transcript, Hartzler played fast and loose in her comments about the implied Chinese threat, offering:

… no evidence that they’re [i.e. the Chinese] spending the money on this [i.e. military buildup], but just the suggestion that they could be. She also cites China when explaining why we shouldn’t cut defense. She doesn’t mention the fact that we’re outspending them 7 to 1 and have been for so long that her fears about China are probably unfounded

Hartzler, of course, is not the only winger parlaying fear of the Chinese into a tool to cut social spending. She may be silly enough to actually believe the twaddle she’s peddling, but, in the wider context, I think Dean Baker has the right of it:

So, why do all the deficit hawks talk about borrowing money from China? They do it for the same reason that George HW Bush talked about Willie Horton when he was running against Michael Dukakis. It works.

The deficit hawks want the country to agree to take steps that are incredibly unpopular. They want the public to support the gutting of essential support programmes for the middle class like social security and Medicare. Naturally, this is a hard sell. Therefore, if it takes a little China bashing to make the policy go down easier, the deficit hawks are perfectly prepared to go that route. That’s the way politics works in the United States.

* Gross national debt is made up of intragovernmental debt and public debt or net debt; foreign debt is that portion of public debt that is held by foreign entities.